What is a GST return?

All entities obtaining GST registration are required to file the GST returns every month. GST return is a document which contains details of the income that a taxpayer is required to file. This is used to calculate the tax liability i.e., the amount of tax payable by the business.

The returns are to be filed irrespective of business activity, sales, profitability and other criteria. A dormant business which has not issued any invoice is also required to file its GST returns.

GST Return Filing

Registered entities are required to file 2 monthly returns and 1 annual return, for a total of 26 returns in a year.

Entities have to file the GSTR-3B return every month providing details of sales and purchases made in a month. In addition to the GSTR-3B return, businesses registered under GST must file GSTR-1 returns. GSTR-1 return must be filed every month by businesses having an annual revenue of over Rs.1.5 crores.

In case a business has a yearly revenue of less than Rs.1.5 crores, GST returns should be filed every quarter. Annual GST returns must also be filed by all entities in addition to the above.

Penalty for late filing

Penalties and cancellation of the GST registration will result if an entity fails to file GST returns on time. In-case of non-compliance for more than six months consecutively, the entity would be unable to obtain another registration in addition to cancellation- until all the penalties are paid back in full.

The penalties for entities having no turnover is different when compared to entities having a certain turnover. NIL returns must be filed in case of no turnover and failure to do so will result in a penalty of Rs. 20 per day.

Established businesses will be levied with a penalty of Rs. 50 per day for the period of late-filing. A penalty of Rs. 50 per day will be applicable for late GSTR-3B return and Rs.50 per for GSTR-1 return. In total, a penalty of more than Rs.3000 per month would be incurred. In addition to the above late filing fees, the entity would also have to pay interest at the rate of 18% on GST payment remitted late.

*As per 40th GST council meeting, the penalty for late filing has been waived off.

Composition Scheme Filing

All entities registered under the composition scheme are required to file form GSTR-4A every quarter through the GST portal or through a GST facilitation centre.

GST returns for those enrolled under the composition scheme is due on the 18th of the month every quarter. Hence, GST return filing for the composition scheme would be due on April 18th, July 18th, October 18th and January 18th.

The returns filed must include details of the following:

- Inter-State and intra-State inward supplies received from registered and unregistered persons

- Consolidated details of outward supplies

Even if an entity opted for the composition scheme starting April of that year, it must continue filing monthly GST returns until September of the same year.

Composition Scheme – Due dates

The GST composition returns, the taxpayer is also required to pay all liabilities towards tax, interest, penalty, fees or any other amount payable under GST.

GST composition tax is levied at the following rates:

- Manufacturers, other than manufacturers of such goods as may be notified by the Government – 1%.

- Suppliers making supplies – 2.5%

- Any other supplier eligible for composition levy – 0.5%

Its important to note that any taxpayer who has opted the GST composition scheme will not be eligible to avail input tax credit on receipt of invoices or debit notes from the supplier for the period prior to opting for the composition scheme.

GST RETURN FILING PROCESS IS REQUIRED

Dedicated GST advisor

Collection of purchase and sales invoice returns prepared using LEDGERS GST Software

GSTR-1 and GSTR-3B return filing

Input Tax Credit reconciliation

Full stack accounting and cloud storage of records for easy retrieval and usage

Monthly accounts report

The average time taken to file a GST return is about 1 – 3 working days, subject to the government processing time and client document submission.

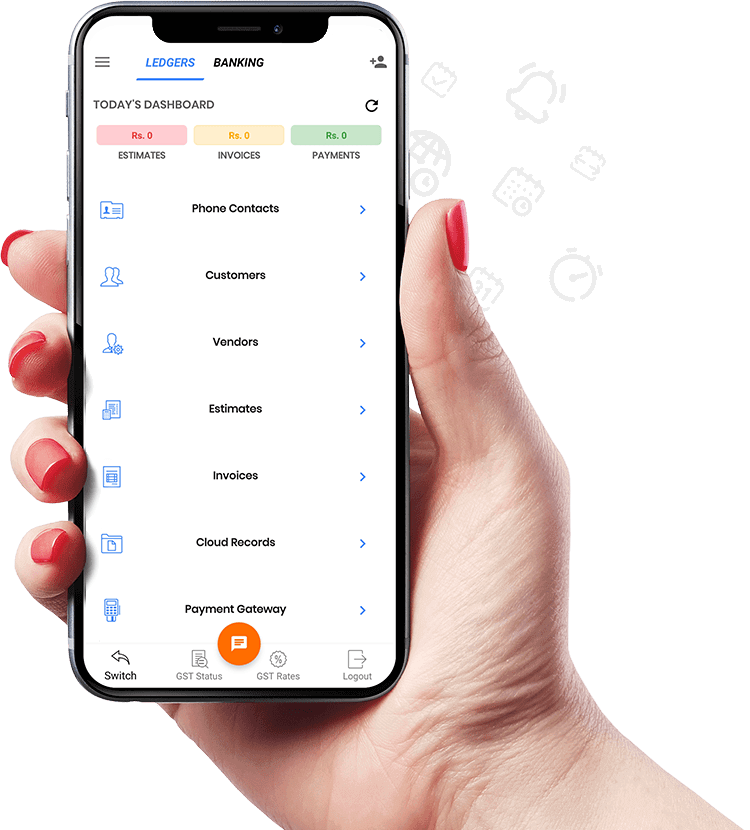

LEDGERS GST SOFTWARE

In addition to the GST advisor support, LEDGERS GST Software will be provided to the client for GST invoicing, payments, returns filing and accounting.

Some of the features of LEDGERS are:

- Customer management

- Supplier management

- GST Invoicing

- Estimate issuance & tracking

- Accounts receivables tracking

- Purchase register

- Payments tracking

- Payables management

- Automated GST return filing (GSTR-1, GSTR-3B)

- Automatic Input Tax credit reconciliation

- GST eWay bill generation & management

- ICICI bank integration

IMPORTANT DUE DATES

- GSTR-1 (Monthly)

10th of every month

Monthly GSTR 1 returns must be filed by taxpayers having a turnover of more than Rs.1.5 crores. For example, filing for the month of December is due on 11th of January.

- GSTR-1 (Quarterly)

15th of every quarter

Quarterly returns must be filed by taxpayers having a turnover of less than Rs.1.5 crores. For example, GSTR-1 quarterly returns for the months of October to December is due on 31st January.

- CMP-08- Quarterly-Composition Scheme

18th of every quarter

CMP-08 must be filed by taxpayers registered under the GST composition scheme having a turnover of upto Rs.1 Crore. For example, the statement cum challan for the September to December quarter is due on 18th January.

- GSTR-4- Annual-Composition scheme

30th April

GSTR-4 returns filing for the financial year is due on 30th April. Quarterly returns must be filed by taxpayers registered under the GST composition scheme having a turnover of upto Rs.1 Crore.

- GSTR-9- Annual returns

31st January

Annual GST return filing for the financial year is due on 31st January. This is mandatory for all entities.